fulton county ga vehicle sales tax

We encourage taxpayers to utilize online services. Not all that is for one government however.

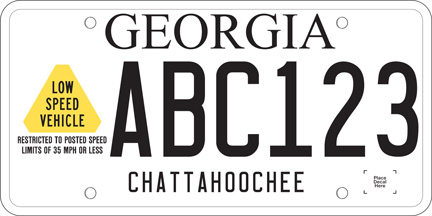

Sales Tax On Cars And Vehicles In Georgia

There is no charge for this service.

. The Tax Commissioner takes the appraised value and the exemption status provided by the Board of Tax Assessors along with the millage rates set by the Board of Commissioners and other. A county-wide sales tax rate of 26 is applicable to localities in Fulton County in addition to the 4 Georgia sales tax. The Fulton County Sheriffs Office month of November 2019 tax sales.

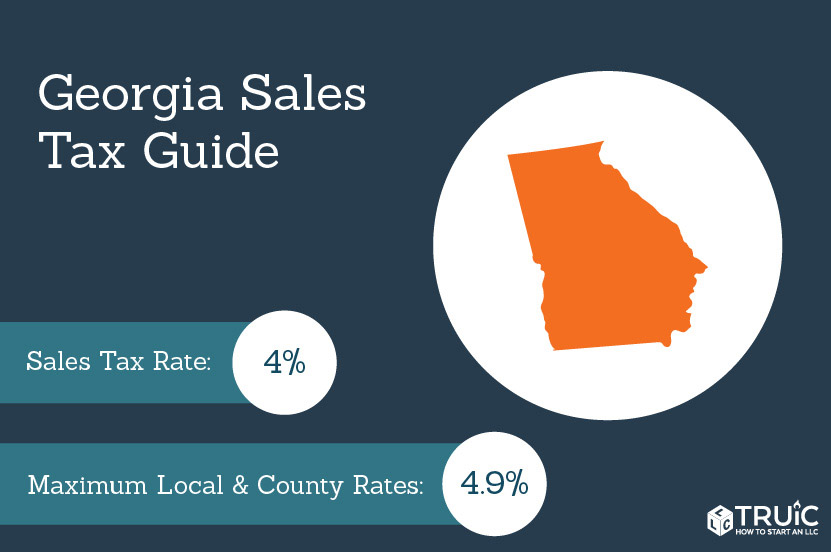

The total 775 Fulton County sales tax rate is only applicable to businesses and sellers that are not in the Greater Atlanta area. The Fulton County Georgia sales tax is 775 consisting of 400 Georgia state sales tax and 375 Fulton County local sales taxesThe local sales tax consists of a 300 county sales tax and a 075 special district sales tax used to fund transportation districts local attractions etc. If your business is based in Atlanta or you sell to customers in Atlanta then the sales tax rate is.

These buyers bid for an interest rate on the taxes owed and the right to collect back that money plus an interest. SW TG500 Atlanta GA 30303 to receive their total amount due to Fulton County Sheriffs Office. The majority -- 4 percent -- goes to Georgia as part of the state sales tax rate.

Fulton County homeowners can qualify for a variety of homestead exemptions offered through the Fulton County Tax Assessors office. Winning Bidder- Upon the conclusion of the Tax Sale the winning bidder will come back within 1 hour to 185 Central Ave. The Fulton County sales tax rate is.

Winning Bidder must pay by 4 pm on the 1 st Tuesday of the month. The Fulton County Sales Tax is 3. The base sales tax rate for transactions within Milton and most of Fulton County is 775 percent.

The Fulton County Tax Commissioner is responsible for collecting property taxes on behalf of Fulton County Government two school systems and some city governments. The Tax Commissioner takes the appraised value and the exemption status provided by the Board of Tax Assessors along with the millage rates set by the Board of Commissioners and other. The City of Fulton has depended on the vehicle sales tax averaging between 40000 and 120000 each.

On Tuesday August 2 City of Fulton residents have an opportunity to vote on continuing a vehicle sales tax on motor vehicles trailers boats and outboard motors purchased from outside the state of Missouri. Fulton County GA currently has 3661 tax liens available as of April 15. Bidders must register each month for the Tax Sale.

Combined with the state sales tax the highest sales tax rate in Georgia is 9 in the cities of. The Georgia state sales tax rate is currently. This calculator can estimate the tax due when you buy a vehicle.

Some cities and local governments in Fulton County collect additional local sales taxes which can be as high as 19. It replaced sales tax and annual ad valorem tax annual motor vehicle tax and is paid every time vehicle ownership. Get a Vehicle Out of Impound.

Fulton County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Fulton County Georgia. If the renewal issuance date has exceeded 90 days and you have not received the decal there will be a 800 replacement fee. Our offices are open to the public with limited staffing.

This is the total of state and county sales tax rates. Has impacted many state nexus laws and. In other words if you buy or sell something for 100 an additional 775 goes toward sales taxes.

The latest sales tax rate for Atlanta GA. The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. Vehicle Sales Tax Information.

However if you need to visit one of our offices we request that an appointment be made in advance. Online Services Fulton County Board of Assessors. Business Certificate of Exemption Georgia veterans are eligible for a certificate granting exemption from any occupation tax administrative fee or regulatory fee imposed by local governments for peddling conducting business or practicing a profession or semi-profession for a period of ten.

If is has not been 30 days since the renewal issuance date you must wait until 30 days has lapsed before a replacement can be issued. The 2018 United States Supreme Court decision in South Dakota v. 2020 rates included for use while preparing your income tax deduction.

For more information on vehicle tax exemptions contact your local County Tax Office. Title Ad Valorem Tax TAVT The current TAVT rate is 66 of the fair market value of the vehicle. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Fulton County GA at tax lien auctions or online distressed asset sales.

The base rate of Fulton County sales tax is 375 so when combined with the Georgia sales tax rate it totals 775. Fulton County has one of the highest median property taxes in the United States and is ranked 220th of the 3143 counties in order of median property taxes. The Fulton County Tax Commissioner is responsible for collecting property taxes on behalf of Fulton County Government two school systems and some city governments.

Title Ad Valorem Tax TAVT became effective on March 1 2013. The median property tax in Fulton County Georgia is 2733 per year for a home worth the median value of 253100. This rate includes any state county city and local sales taxes.

Please call 404-612-6440 to schedule an appointment. GA 30303 404-612-4000 customerservicefultoncountygagov. Title Ad Valorem Tax TAVT The current TAVT rate is 66 of the fair market value of the vehicle.

Click here for a larger sales tax map or here for a sales tax table. Due to renovations at the Fulton County Courthouse. The tax rate for the portion of a motor vehicle sale that exceeds 500000 is 6 because the 1 2nd LOST and the 1 TSPLOST do not apply.

For TDDTTY or Georgia Relay Access. Heres how Fulton Countys maximum sales tax rate of 85 compares to other counties around the United States. Georgia has state sales tax of 4 and allows local governments to collect a local option sales tax of up to 4There are a total of 476 local tax jurisdictions across the state collecting an average local tax of 3683.

TAVT is a one-time tax that is paid at the time the vehicle is titled. This tax is based on the value of the vehicle. The tax must be paid at the time of sale by Georgia residents or within six months of establishing residency by those.

These include basic homestead exemptions as well as homestead exemptions for seniors low income homeowners surviving spouses of public safety and military personnel killed in the line of duty and others. Effective October 1 2018 the generally applicable tax rate in Ware County is 9 state sales tax at the statewide rate of 4 plus 5 local sales taxes at a rate of 1 each. If you need reasonable accommodations due to a disability including communications in an alternative format please contact the Disability Compliance Liaison at 404612-9166.

These records can include Fulton County property tax assessments and. The Fulton County Sales Tax is collected by the merchant on all qualifying sales made within. Fulton County collects on average 108 of a propertys assessed fair market value as property tax.

How To Sell A Car In Georgia Transfer A Title And More

![]()

Georgia New Car Sales Tax Calculator

Georgia Used Car Sales Tax Fees

Fulton County To Add Additional Tag Renewal Kiosks In Atlanta

Georgia Title Transfer Buyer Instructions Youtube

Georgia Car Title Transfer Guide Sell A Car In Georgia Fast

Motor Vehicle Division Georgia Department Of Revenue

Updates To Georgia Lease Tax Canton Ga Serving Alpharetta And Atlanta

Free Vehicle Power Of Attorney Form For Georgia Adobe Pdf T 8

Georgia Sales Tax Small Business Guide Truic

Interrupted Tag Title Services Occurring This Week

How Much Are Tax Title And License Fees In Georgia Langdale Ford

Tax Commissioner S Office Cherokee County Georgia

As Georgia Recruits Electric Vehicle Maker Rivian The Number Of Evs And Charging Stations Lags