nd sales tax exemption form

22 nd Bridge Kennedy. Regarding sales tax payment for the 2013-14.

How To Get A Certificate Of Resale In North Dakota Startingyourbusiness Com

Form 306 Income Tax Withholding Return must be filed even if an employer did not pay any wages during the period covered by the return.

. Floridas definition of what qualifies as custom software is broader than many other states because it considers a software program to be exempt if a salesperson or technician surveys a buyers needs and makes recommendations. Florida provides a sales tax exemption for software that is either custom or electronically transferred. Requirements for Information Returns.

Sample Format for Sales Tax Letter. To Henry Williams Sales Manager Sales Tax department New York. If the number of returns to be filed with North Dakota is 10 or more for tax year 2021 the following must be submitted electronically through ND TAP or an accounting software.

Applications are due before June 1 following the year for which the refund is claimed. The Application for Senior Citizens or Permanently and Totally Disabled Renters Property Tax Refund is available mid-January through May 31 of each year. Renters Refund Tax Application to the Office of State Tax Commissioner.

Respected Sir This is in context with the sales tax payment of my company Unique Crockery Stores for the financial year 2013.

Form 21999 Fillable Streamlined Sales And Use Tax Agreement Certificate Of Exemption

Nd Form St 2016 2022 Fill Out Tax Template Online Us Legal Forms

Form Sfn 21854 Certificate Of Purchase Exempt Sales To A Person From Montana

North Dakota Kheops International

Free Form 21919 Application For Sales Tax Exemption Certificate Free Legal Forms Laws Com

E 595e Web Fill 12 09 Fill Online Printable Fillable Blank Pdffiller

Form 21919 Application For Sales Tax Exemption Certificate

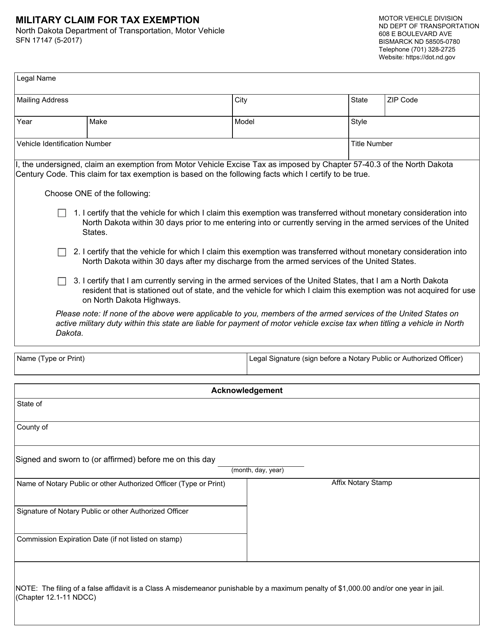

Form Sfn17147 Download Fillable Pdf Or Fill Online Military Claim For Tax Exemption North Dakota Templateroller